ATV Loan Calculator

Calculate your ATV loan payments and view the complete amortization schedule

| Month | Principal | Interest | Total Payment | Remaining Balance |

|---|

When considering an ATV loan, many potential buyers are often overwhelmed by the complexity of financing options, interest rates, and payment terms. Navigating through the variety of loan providers, understanding how credit scores impact loan eligibility, and determining monthly payments can cause confusion and stress.

Our ATV Loan Calculator offers a clear, efficient solution by providing instant estimates of your monthly payments based on loan amount, interest rates, and loan term, helping you make informed decisions with ease.

Whether you’re purchasing a new or used ATV, our tool ensures you stay within budget while securing the best loan terms available. Additionally, the calculator takes into account factors like down payments, trade-ins, and special financing offers, giving you a comprehensive overview of your financial commitment.

By using our easy-to-use calculator, you can eliminate uncertainty and confidently plan your ATV purchase, ensuring it fits seamlessly into your financial goals.

How to Calculate ATV Loan Using Our Tool?

Using our ATV Loan Calculator is straightforward and can be done in a few simple steps. Here’s how:

- Enter the ATV Price: Start by inputting the total price of the ATV you’re interested in.

- Down Payment: Specify the percentage you plan to pay upfront. This will reduce the total loan amount.

- Interest Rate: Enter the interest rate you’ve been offered by your lender. This is usually based on your credit score and the loan term.

- Loan Term: Choose the loan term (in months) that suits your budget. Common terms range from 24 to 84 months.

Once you fill in these details, click the Calculate button. Our tool will instantly show you:

Additionally, our tool will generate a detailed amortization schedule showing how much of each payment goes toward principal and interest.

How to Calculate ATV Loan Payments Manually?

If you prefer to calculate your ATV loan payment manually, the process involves using a formula that takes into account the loan amount, interest rate, and loan term.

Here’s a simple breakdown of the steps involved in calculating the monthly payment for your ATV loan, along with examples to make it easier to follow.

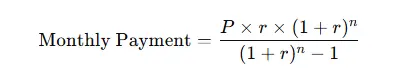

Loan Payment Formula:

The formula to calculate your monthly payment is as follows:

Step 1: Calculate the Loan Amount (P)

The loan amount is the price of the ATV minus your down payment.

Step 2: Find the Monthly Interest Rate (r)

To calculate the monthly interest rate, divide your annual interest rate by 12. This gives you the monthly interest rate.

Example: If your loan has an annual interest rate of 6%, you would convert it to a monthly interest rate like this:

So, your monthly interest rate (r) is 0.005.

Step 3: Determine the Loan Term in Months (n)

Next, you need to calculate the loan term in months. Multiply the number of years in your loan term by 12 to convert it into months.

Example: If you have a 3-year loan term:

So, your loan term (n) is 36 months.

Step 4: Apply the Formula

Now that you have all the necessary information, plug the numbers into the formula to calculate your monthly payment.

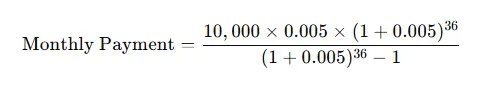

Example: Using the values from the examples:

The formula would look like this:

Step-by-step:

Top 5 Strategies to Finance an ATV

1. Personal Loan

What is it?

A personal loan is an unsecured loan, meaning you don’t need to offer collateral. It’s a common financing method for big purchases like ATVs.

Why consider it?

Personal loans typically offer fixed interest rates and fixed monthly payments, which makes it easier to budget for your ATV purchase.

How to use it?

- Apply through a bank or credit union.

- Compare loan amounts, interest rates, and repayment terms.

- Example: If you borrow $5,000 at an interest rate of 8% over 3 years, your monthly payment might be around $157. This can help you keep your payments manageable.

Things to note:

- Ensure your credit score qualifies for a lower interest rate.

- Be mindful of loan fees and early repayment penalties.

2. Dealer Financing

What is it?

Many ATV dealerships offer in-house financing, which means you borrow directly from the dealership.

Why consider it?

Dealer financing can be convenient because you can often secure a loan on the spot when purchasing your ATV. Some dealerships may also offer promotional deals, such as 0% interest for a limited period.

How to use it?

- Visit an ATV dealership.

- Ask about the financing options available, and compare interest rates.

- Negotiate terms, especially if they offer special financing promotions.

Things to note:

- Interest rates can vary. Sometimes they are higher than personal loans.

- Check the fine print for hidden fees or deferred interest rates.

3. Home Equity Loan

What is it?

If you own a home, you can borrow against the equity (the difference between what you owe on your mortgage and your home’s value). This can offer a low-interest way to finance large purchases like an ATV.

Why consider it?

Home equity loans generally offer lower interest rates compared to unsecured loans, making them a cost-effective option if you have significant equity in your home.

How to use it?

- Evaluate your home’s equity to see if you can qualify.

- Apply for a home equity loan through a bank, credit union, or lender.

- Typically, the loan terms are around 10 to 20 years with a fixed interest rate.

Things to note:

- Your home is used as collateral, so if you default, you risk losing it.

- Only consider this option if you’re confident in your ability to repay the loan.

4. Credit Card Financing

What is it?

Using a credit card to finance your ATV can be an option if you have a high credit limit and the card offers low or 0% interest for a promotional period.

Why consider it?

Credit card financing is fast and can provide flexibility. If you’re able to pay off the balance before the interest rate increases, this could be a cost-effective option.

How to use it?

- Check your credit card’s available credit and interest rates.

- Take advantage of introductory 0% APR offers if your credit card has them.

- Pay off the balance within the promotional period to avoid high interest.

Things to note:

- High-interest rates will apply if the balance isn’t paid off before the introductory period ends.

- Be mindful of credit utilization ratios, as it can affect your credit score.

5. Peer-to-Peer Lending

What is it?

Peer-to-peer (P2P) lending involves borrowing money from individual investors, typically through an online lending platform.

Why consider it?

P2P lending often offers competitive interest rates, and the application process can be faster and more flexible than traditional bank loans.

How to use it?

- Research and sign up for a P2P lending platform like LendingClub or Prosper.

- Fill out the application, provide financial information, and get approved for a loan.

- Once approved, receive the loan from individual investors.

Things to note:

- Interest rates vary based on your credit profile and the investors.

Late payment penalties or origination fees may apply.

Understanding the Components of an ATV Loan

When you take out an ATV loan, there are several key components that determine the overall cost and repayment terms. Each element plays an important role in shaping your monthly payments and the total amount you will pay over time.

Let’s break down these components step-by-step, along with examples to help you fully understand how each one affects your loan.

1. Principal: The Loan Amount You Borrow

The principal is the initial amount of money you borrow from the lender to purchase your ATV. This is the starting point for calculating how much you’ll owe, excluding any interest or fees.

- Example: If the ATV costs $12,000 and you’re financing the entire amount with a loan (without a down payment), the principal would be $12,000.

Related Terms: Loan Amount, Borrowed Amount, ATV Price

2. Interest Rate: The Cost of Borrowing

The interest rate is the percentage charged by the lender for borrowing money. This is how lenders make a profit from lending you the principal amount. The interest rate is usually expressed annually (annual percentage rate, or APR) but will need to be converted to a monthly rate for your calculations.

- Example: If your loan has an annual interest rate of 6%, the monthly interest rate would be: Monthly Interest Rate=6%12=0.5%\text{Monthly Interest Rate} = \frac{6\%}{12} = 0.5\%Monthly Interest Rate=126%=0.5% or 0.005 when written as a decimal.

Related Terms: APR, Loan Interest, Monthly Rate, Borrowing Cost

3. Loan Term: The Length of Your Loan

The loan term is the length of time you have to repay the loan, typically expressed in months or years. The term directly impacts the size of your monthly payment—a longer loan term means smaller monthly payments but a higher total amount paid due to more interest over time.

- Example: If you opt for a 3-year loan term, the loan will be repaid over 36 months. A 5-year loan term would mean 60 monthly payments.

Related Terms: Loan Duration, Repayment Period, Term Length, Amortization Period

4. Down Payment: Your Initial Contribution

The down payment is the amount you pay upfront toward the cost of the ATV. The larger the down payment, the smaller your principal will be, which can result in lower monthly payments and reduced total interest paid over the course of the loan.

- Example: If the ATV price is $12,000, and you make a down payment of $3,000, your new loan amount (principal) would be $9,000. A higher down payment reduces the loan amount, making the monthly payment lower.

Related Terms: Initial Payment, Upfront Payment, Equity Contribution, Cash Payment

5. Monthly Payment: Your Regular Loan Repayment

The monthly payment is the amount you pay to the lender each month to repay the loan. This amount is determined by the principal, the interest rate, and the loan term. The monthly payment consists of two parts: the repayment of the principal and the payment of interest.

- Example: Based on the loan amount of $9,000, the interest rate of 6%, and a loan term of 36 months, your monthly payment could be approximately $274. This amount may vary slightly based on the exact interest calculation method used by the lender.

Related Terms: Repayment, Loan Installment, Monthly Installment, Loan Payment Schedule

How These Components Work Together:

Each of these components—principal, interest rate, loan term, down payment, and monthly payment—interact with one another to determine the overall cost of your ATV loan. For example:

- A larger down payment lowers the principal, which reduces both the monthly payment and the total amount of interest paid over the term of the loan.

- A shorter loan term results in higher monthly payments but reduces the amount of interest you pay over time.

- A higher interest rate increases your monthly payment and the total cost of the loan.

Factors Affecting Aircraft Loans

When securing an aircraft loan, various factors influence the loan terms, interest rates, and overall financing costs. Understanding these elements can help you make informed decisions and find the best loan options. Below is a detailed step-by-step breakdown of the factors that can impact your aircraft loan:

Credit Score

- What it is: Your credit score is a numerical representation of your creditworthiness, based on your credit history and financial behavior.

- How it affects your loan: Lenders use your credit score to assess the risk of lending to you. A higher credit score indicates to lenders that you’re a lower risk, making them more likely to offer favorable loan terms. A higher score often translates to lower interest rates, reducing the overall cost of the loan.

- Tip: Aim for a credit score above 700 to increase your chances of securing a loan with competitive interest rates. Scores below 650 may lead to higher interest rates or difficulty obtaining financing.

Down Payment

- What it is: The down payment is the upfront amount you pay toward purchasing the aircraft. This is usually a percentage of the total price.

- How it affects your loan: A larger down payment reduces the amount you need to borrow, lowering your loan balance. The more you can put down initially, the less you will need to finance, which can lead to lower monthly payments and reduced interest costs.

- Tip: Many lenders require a down payment of at least 10-20%. However, a larger down payment (such as 30% or more) can improve your loan terms and reduce the amount of interest paid over time.

Loan Term

- What it is: The loan term is the length of time over which you agree to repay the loan. Typical loan terms for aircraft financing range from 5 to 25 years, depending on the loan amount and type of aircraft.

- How it affects your loan: A longer loan term results in lower monthly payments, as the total loan amount is spread over a longer period. However, this also means that while you pay less each month, the total interest you pay over the life of the loan increases.

- Tip: If you’re looking for lower monthly payments, a longer loan term might be beneficial. However, if you can afford higher monthly payments, opting for a shorter loan term will reduce the total interest paid and allow you to pay off the loan faster.

Interest Rate

- What it is: The interest rate is the cost of borrowing money, expressed as a percentage. It is added to the principal balance of the loan and impacts the total amount you repay over time.

- How it affects your loan: Interest rates can vary based on several factors, including the lender’s policies, current market conditions, and your creditworthiness. Rates can be fixed (remaining the same throughout the loan term) or variable (fluctuating based on market conditions). Lenders may also adjust rates based on the type of aircraft you are purchasing.

- Tip: Shop around for competitive interest rates and consider whether a fixed or variable rate makes more sense for your financial situation. Be aware of how market conditions may affect your loan if you choose a variable rate.

Interest Rate

- What it is: The type of aircraft you are purchasing is another key factor. Lenders may offer different financing terms depending on whether you’re buying a small general aviation aircraft, a newer model, or a luxury jet.

- How it affects your loan: Newer aircraft or luxury jets often have higher financing costs because they are perceived as having higher resale values. Lenders may offer better terms for newer or more expensive aircraft but could also require a higher down payment or charge higher interest rates to reflect the risk involved in financing expensive equipment.

- Tip: Be mindful of the type of aircraft you’re purchasing. The age, condition, and brand of the aircraft can all influence your loan’s terms and interest rates. If you’re financing a private jet or a high-end model, expect higher financing costs.

Final Verdict

In conclusion, securing financing for an aircraft, whether a private jet, small plane, or helicopter, can be a complex and overwhelming process.

The key factors to consider include the principal amount, interest rate, loan term, and monthly payments, which all influence the overall affordability and long-term financial commitment.

Our aircraft loan calculator simplifies this process by offering real-time, accurate estimates tailored to your needs, allowing you to compare down payment options, interest rates, and loan durations with confidence.

By understanding these financing options and using the calculator or manual calculation methods, individuals and businesses can make informed decisions, avoid financial missteps, and take control of their aviation investments.