Tesla Loan Calculator

Calculate your Tesla car loan payments and view the complete amortization schedule

| Month | Principal | Interest | Total Payment | Remaining Balance |

|---|

Owning a Tesla is a dream for many, but navigating the complexities of car loans, monthly payments, and total interest can feel overwhelming. Questions like “How much will my Tesla cost each month?” or “Can I afford a Model Y or Model 3 on my current budget?” often leave buyers unsure about their next steps.

That’s where a Tesla Loan Calculator becomes essential, providing clarity by breaking down costs, calculating loan amounts, and offering detailed amortization schedules.

This tool simplifies financial planning and helps buyers make informed decisions, whether they’re exploring competitive interest rates, shorter loan terms, or budgeting for the Model S or Cybertruck.

By addressing these concerns, we aim to empower Tesla enthusiasts to confidently and easily turn their dreams into reality.

How Do You Calculate Tesla Loan With Our Tool?

Our Tesla Financing Calculator is an easy-to-use tool that helps you estimate monthly payments, loan amounts, and total costs for your Tesla. Here’s a quick guide:

1. Enter the Tesla Price

Input the price of the Tesla model you’re interested in.

2. Add Your Down Payment

Enter the percentage or amount you’ll pay upfront.

- Example: A 20% down payment on a $60,000 Tesla is $12,000, reducing your loan to $48,000.

3. Set the Interest Rate

Input your lender’s annual percentage rate (APR).

- Example: A rate of 3.5% APR will impact your total cost and monthly payment.

4. Choose the Loan Term

Select a loan period, such as:

5. Click “Calculate”

See instant results, including:

6. Review the Amortization Schedule

The calculator provides a detailed payment breakdown:

Example: Tesla Model 3 Purchase

Results:

The amortization schedule shows the exact portion of each payment going to principal and interest, helping you make informed financial decisions.

How Do You Calculate a Tesla Loan Manually?

Calculating a Tesla loan manually might seem challenging at first, but breaking it down step by step makes it much easier. By understanding the formula and using real-world numbers, you can confidently estimate your monthly payments, total loan cost, and total interest. Here’s how you can do it:

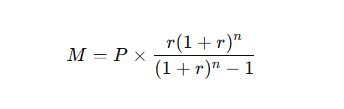

Step 1: Understand the Formula

The formula for calculating monthly loan payments is:

This formula accounts for compound interest, ensuring your monthly payment is accurate for both the principal and the interest.

Step 2: Gather Loan Details

Let’s calculate the loan payments for a Tesla with the following details:

Step 3: Convert the Interest Rate

Since the formula requires the monthly interest rate, divide the annual rate by 12:

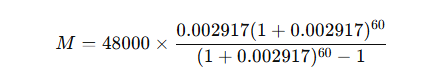

Step 4: Substitute Values into the Formula

Plug the loan details into the formula:

Step 5: Perform the Calculations Step-by-Step

Step 6: Calculate Total Cost and Interest

What Does This Mean for You?

Top 5 Strategies to Finance a Tesla Car

Purchasing a Tesla is an exciting decision, but it’s also a significant financial commitment. Whether you’re eyeing the Tesla Model 3 for its affordability or the Tesla Model X for its luxury, careful financial planning can make your dream car a reality.

Here are five detailed strategies to help you finance your Tesla while managing costs effectively:

1. Save for a Larger Down Payment

- Why It Matters: A larger down payment reduces the total loan amount you need to borrow. This results in lower monthly payments, less interest paid over time, and better loan terms.

- Recommended Amount: Aim for at least 20% of the vehicle’s price. For example, if the Tesla Model 3 costs $40,240, a 20% down payment would be $8,048. A higher down payment may also improve your creditworthiness in the eyes of lenders.

How to Save:

2. Shop for Competitive Interest Rates

Why It Matters: Interest rates significantly impact your overall loan cost. Even a small difference in the rate can save you thousands of dollars over the loan term.

What to Compare:

- Local banks and credit unions often offer competitive rates for auto loans.

- Online lenders may have special promotions for electric vehicles.

- Tesla itself provides financing options that could include incentives like lower rates or deferred payments.

3. Opt for Shorter Loan Terms

Why It Matters: Shorter loan terms lead to higher monthly payments, but they drastically reduce the total interest you’ll pay. This can save you money in the long run and help you own your Tesla outright faster.

Typical Loan Terms:

- Standard terms: 60 months (5 years)

- Shorter options: 36 or 48 months (3 or 4 years)

Example:

- A $48,000 loan over 60 months at 3.5% interest costs $491 in total interest.

- The same loan over 36 months at the same rate costs just $268 in total interest—a savings of $223.

Consider Your Budget: While shorter terms save money overall, ensure your monthly payment fits comfortably within your financial plan.

4. Explore Tesla’s Financing Options

Why It Matters: Tesla offers financing programs tailored specifically to their vehicles, often with perks like lower interest rates or streamlined approvals.

What Tesla Financing Offers:

- Competitive interest rates that rival traditional lenders.

- Flexible loan terms range from 24 to 72 months.

- Transparent and user-friendly online application processes.

Example: Tesla frequently updates its financing promotions, such as offering reduced rates for specific models like the Model Y or special programs for corporate buyers or fleet purchases.

Additional Perks: Tesla financing may also include options for residual-value loans or trade-in programs to make upgrading to a newer Tesla easier in the future.

5. Lease Instead of Buying

Why It Matters: Leasing is a practical alternative to outright ownership, especially if you prefer lower monthly payments or want to upgrade to the latest Tesla model every few years.

How Leasing Works:

- You pay for the car’s depreciation during the lease period, plus fees and interest.

- At the end of the lease, you can either return the car or purchase it at a predetermined price.

Advantages:

- Lower monthly payments compared to financing a purchase.

- Minimal upfront costs, often requiring just the first payment and fees.

- Flexibility to upgrade to newer Tesla models, such as moving from the Model 3 to the Cybertruck.

Example:

Leasing a Tesla Model S might cost $1,299 per month for 36 months with a $5,000 initial payment, compared to a $1,694 monthly payment if financed over 60 months.

Is Leasing Right for You?: Leasing works well for those who drive fewer miles annually or prefer having the latest technology every few years. However, be mindful of mileage limits and potential wear-and-tear charges.

Bonus Tip: Consider Tax Credits and Incentives

- Federal Incentives: The Clean Vehicle Tax Credit offers up to $7,500 for eligible Tesla models, reducing your overall cost.

- State and Local Rebates: Many states provide additional incentives, such as cash rebates or reduced registration fees for electric vehicles.

- Utility Discounts: Some utility companies offer rebates for installing home charging stations, which can save you hundreds of dollars.

Tesla Models and Their Prices

Here’s a quick comparison of Tesla models to help you decide which fits your budget.

| Model | Starting Price ($) | Range (Miles) | Top Speed (MPH) | 0–60 MPH (Seconds) |

|---|---|---|---|---|

| Tesla Model 3 | 40,240 | 358 | 145 | 5.8 |

| Tesla Model Y | 47,740 | 330 | 135 | 4.8 |

| Tesla Model S | 88,490 | 405 | 200 | 3.1 |

| Tesla Model X | 98,490 | 348 | 155 | 3.8 |

| Tesla Cybertruck | ~50,000 (Estimated) | 500+ (Estimated) | TBD | TBD |

Note: Prices and specifications are subject to change.

Final Verdict

Financing a Tesla doesn’t have to be overwhelming. Tools like the Tesla Loan Calculator make it easy to understand your financial commitments, while manual calculations provide a deeper dive into the numbers.

By exploring different financing strategies, comparing Tesla models, and using our calculator, you’re better equipped to make an informed decision.

Whether you’re drawn to the efficiency of the Model 3 or the luxury of the Model S, understanding your loan options ensures you can enjoy the Tesla experience without financial stress.

Get started today with our Tesla Loan Calculator and take the first step toward owning your dream car.