Bridge Loan Calculator

Current Property Details

New Property Details

Bridge Loan Terms

When transitioning from one property to another, many homeowners face the challenge of securing financing for a new home while still carrying the mortgage on their current property.

This situation often leads to financial uncertainty, as waiting for the sale of your current home may delay your purchase. A bridge loan offers a temporary solution, but the complexities of understanding loan amounts, interest rates, and repayment schedules can be overwhelming.

Our Bridge Loan Calculator simplifies this process, allowing you to quickly calculate monthly payments, total interest, and overall loan costs.

By providing you with accurate, easy-to-understand results, our tool helps you navigate the financial gap between homes, offering clarity and peace of mind as you move forward with your property plans.

How to Calculate a Bridge Loan Using Our Tool?

Using our Bridge Loan Calculator is simple. Here’s a step-by-step guide:

- Enter Current Property Details:

- Current Property Value: This is the estimated market value of your current property. For example, let’s say it’s $300,000.

- Outstanding Mortgage: The amount you still owe on your current mortgage. For instance, $200,000.

- Enter New Property Details:

- New Property Purchase Price: The price of the property you plan to buy, such as $400,000.

- Input Bridge Loan Terms:

- Bridge Loan Amount: This is how much you need to borrow to bridge the gap. Let’s assume $100,000.

- Interest Rate: The interest rate applied to the bridge loan. In this example, it’s 6.7%.

- Loan Term: Typically, bridge loans are short-term, lasting around 12 months. You can set it accordingly.

- Calculate the Loan: Once all details are entered, click the Calculate button. Our tool will provide the Monthly Payment, Total Interest, and Total Cost of the loan, along with a detailed Amortization Schedule.

For this example, your monthly payment would be approximately $8,638.85, with a total interest of $3,666.21, and a total cost of $103,666.21 over the 12 months.

How to Calculate a Bridge Loan Manually?

If you prefer to calculate a bridge loan manually, it’s important to break the process down into simple, clear steps. Here’s a detailed, step-by-step guide, with specific examples, to help you understand the calculation process:

Step 1: Determine the Loan Amount

The first thing you need to calculate is how much money you need to borrow. This is called the loan amount.

Step 2: Calculate Monthly Payments Using the Amortization Formula

Now that you know the loan amount, you need to calculate your monthly payments. To do this, you’ll use a formula called the loan amortization formula.

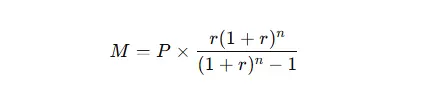

Formula:

Where:

Let’s go through the steps to use this formula with an example:

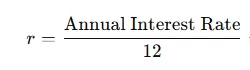

First, calculate the monthly interest rate r:

r = Annual Interest Rate ÷ 12

= 6.7% ÷ 12

r = 0.0055833

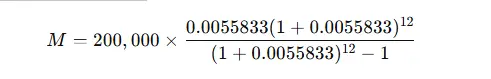

Next, plug the values into the formula:

When you calculate this, you get a monthly payment of approximately $17,443.45.

So, your monthly payment would be $17,443.45 over the 12-month term.

Step 3: Calculate Total Interest and Total Cost

Now, let’s calculate the total interest you will pay on the loan and the total cost of the bridge loan.

So, the total interest you will pay over 12 months is $9,320.94.

So, the total cost of the bridge loan will be $209,320.94.

Summary of Manual Calculation Example

By following these steps, you can manually calculate the amount you need to borrow, how much you’ll pay each month, and the total cost of your bridge loan. While this can be done manually, many people find it easier and faster to use an online bridge loan calculator for quick and accurate results!

Factors Affecting Bridge Loan

When calculating a bridge loan, several factors can influence the terms:

- Current Property Value: The more your current property is worth, the less you may need to borrow.

- Outstanding Mortgage: A larger outstanding mortgage could affect the total loan amount needed.

- Interest Rate: Higher interest rates will increase your monthly payments and overall costs. Rates vary depending on your creditworthiness and the lender.

- Loan Term: A longer loan term means lower monthly payments, but higher overall interest costs.

- Down Payment on New Property: The size of your down payment can reduce the loan amount you need.

Final Verdict

A Bridge Loan Calculator is an essential tool for anyone considering a bridge loan for their real estate transaction. It helps you understand your financial obligations by providing quick and accurate insights into how much you will need to borrow and what your payments will be.

The calculator simplifies the process, ensuring you’re better prepared to manage your bridge loan and make informed decisions. Remember, the terms of your bridge loan are affected by various factors, such as property values, interest rates, and the length of the loan.

Whether you calculate it manually or use our tool, having a clear understanding of the costs and payments involved will guide you in making the right choice.