Dental Loan Calculator

Calculate your dental loan payments and view the complete amortization schedule

| Month | Principal | Interest | Total Payment | Remaining Balance |

|---|

Many individuals face the financial challenge of covering costs that may not be fully covered by insurance when considering dental treatments. Whether it’s for routine procedures or more complex treatments like implants or orthodontics, these expenses can quickly add up.

The high cost of dental work often leaves patients searching for financing options, but navigating loans, interest rates, and payment terms can be overwhelming.

Fortunately, a Dental Loan Calculator can simplify the process, offering clarity on monthly payments, total interest, and loan terms. You can easily calculate the best financing option that fits your budget by entering essential details like treatment cost, down payment, and interest rates.

This tool helps you avoid confusion and empowers you to make informed decisions, providing financial peace of mind for your dental care needs.

How Do You Calculate Dental Loans with Our Tool?

Our Dental Loan Calculator is designed to simplify your financial planning for dental treatments. Here’s how you can use it step by step:

- Enter the Treatment Cost ($)

- Start by inputting the estimated cost of your dental treatment. For example, $2,000.

- Set the Down Payment (%)

- Decide on the upfront amount you’re willing to pay. For instance, if you choose 10%, the down payment would be $200.

- Provide the Interest Rate (%)

- Input the annual interest rate offered by your lender. For example, 3.99%.

- Choose the Loan Term

- Select a predefined term (e.g., 36 months) or enter a custom duration that suits your repayment capacity.

- Click ‘Calculate’

- The calculator instantly provides the loan amount, monthly payment, total interest, and overall cost.

- Review the Amortization Schedule

- A detailed breakdown shows monthly payments, including principal and interest, and the remaining balance over time.

This transparency empowers you to make informed decisions and manage your budget effectively.

How Do You Calculate Dental Loans Manually?

If you prefer to calculate your dental loan manually, it involves a bit of math, but with a structured approach, it’s completely manageable.

By following a few simple steps, you can calculate your monthly payments, interest, and total cost, ensuring you have full control over your financial planning. Below is a detailed, step-by-step guide that breaks down each part of the calculation process, using a real-life example.

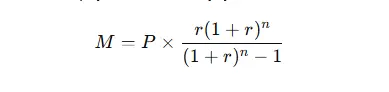

The formula for Monthly Payment:

When calculating your dental loan payments manually, you will use the following formula:

Let’s go through this formula in detail and apply it to a real example.

Step-by-Step Example:

1. Calculate the Loan Amount

The first step is to determine how much you need to borrow, which is the loan amount. This is done by subtracting your down payment from the total treatment cost.

So, the amount you’ll be borrowing is $1,800.

2. Convert the Interest Rate

The next step is to convert the annual interest rate into a monthly interest rate since most loan terms are calculated every month. To do this, simply divide the annual interest rate by 12 (the number of months in a year).

Now you have the monthly interest rate of 0.003325 (which is about 0.33% per month).

3. Determine the Loan Term

Next, you need to figure out how long you plan to take to repay the loan. The loan term is typically measured in months.

This means you’ll be repaying the loan over 36 months. You can adjust this number depending on your situation; shorter terms will increase monthly payments but reduce total interest, while longer terms can lower monthly payments but result in higher total interest.

4. Plug the Values into the Formula

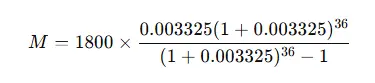

Now that you have all the necessary numbers, plug them into the loan payment formula:

Let’s break down the equation:

By solving this, you get the monthly payment:

- M ≈ 53.14

So, your monthly payment will be $53.14.

5. Calculate Total Interest

Now, let’s calculate the total interest paid over the life of the loan. To do this, first, find out the total cost of the loan by multiplying the monthly payment by the number of months.

Next, subtract the original loan amount from the total cost to determine the total interest paid:

So, over the 36-month loan term, you’ll pay a total of $112.87 in interest.

6. Calculate Total Loan Cost

Finally, to find out the total cost of the loan, add the total interest to the loan amount:

Therefore, the total cost of your loan, including both principal and interest, will be $1,912.87.

Top 5 Strategies to Finance Your Dental Care

Dental treatments, especially more extensive procedures, can be expensive. If dental loans aren’t the right fit for your financial situation, there are several alternative strategies available to help finance your dental care.

Below are five practical methods to consider, each with its advantages and potential drawbacks. Understanding these options will allow you to choose the best path forward based on your budget, treatment needs, and financial goals.

1. Insurance Plans

One of the most common ways to reduce your dental care costs is through dental insurance plans. These plans typically cover a significant portion of preventive care and basic treatments like cleanings, fillings, and exams. However, the extent of coverage can vary depending on the specific plan and provider.

If your current plan doesn’t cover specific treatments or you find that you’re paying more than you’d like out of pocket, you might consider upgrading your policy to a plan with more extensive coverage. Be sure to carefully review the deductibles, premiums, and co-payments associated with the policy before committing.

2. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

If your employer offers a Health Savings Account (HSA) or Flexible Spending Account (FSA), these accounts can be excellent ways to finance dental care by using pre-tax dollars to pay for eligible medical expenses, including dental treatments.

By using pre-tax dollars, both HSAs Reduce your out-of-pocket dental expenses and make it easier to save for future treatments. by using pre-tax dollars

3. Payment Plans with Your Dentist

Many dental practices now offer in-house payment plans that allow you to pay for your dental care over time, making larger treatments more affordable. These payment plans often come with little to no interest, making them an appealing option for patients who want to avoid credit-based financing.

Before signing up, review the terms and conditions carefully and discuss the monthly payment amount that fits comfortably within your budget. Be sure to ask if there are any down payment requirements or restrictions on what treatments are eligible for payment plans.

4. Personal Loans

A personal loan can provide you with a lump sum of money to cover your dental expenses, which you can pay off over a set period. Many people use personal loans for major dental work like root canals, crowns, implants, or even cosmetic dentistry.

When considering a personal loan, make sure to evaluate the total interest you will pay over the life of the loan and choose a loan term that works best for your monthly budget and financial situation.

5. Credit Cards with Promotional APRs

If you’re confident that you can pay off your dental expenses within a specific period, consider using a credit card that offers a 0% introductory Annual Percentage Rate (APR) on purchases for a certain period, usually 6-18 months.

This can be a cost-effective way to pay for dental treatments without accumulating interest during the promotional period.

While credit cards with promotional APRs can be a great way to finance dental care, it’s important to have a clear repayment plan in place to avoid interest charges once the introductory period ends.

Final Verdict

Dental treatments are essential for your overall health, and a Dental Loan Calculator ensures you’re prepared financially. Whether you choose to calculate manually or use our user-friendly tool, understanding your financial commitments helps you make confident decisions.

Combine this knowledge with strategic financing options like insurance, HSAs, or flexible payment plans to ensure your dental care remains accessible and affordable.

Take control of your oral health today, and let our Dental Loan Calculator be your trusted ally in this journey!