Mortgage Recast Calculator

Calculate your new monthly payments after a mortgage recast

| Month | Principal | Interest | Total Payment | Remaining Balance |

|---|

Navigating mortgage payments can feel overwhelming, especially when faced with high monthly obligations, unexpected financial setbacks, or the looming weight of long-term interest costs.

Many homeowners struggle to balance their budgets while trying to reduce debt and improve cash flow, leading to a search for practical and effective solutions.

A Mortgage Recast Calculator offers a clear path forward, showing how a single lump sum payment toward your principal can significantly lower monthly payments and save thousands in interest.

For those managing financial windfalls, tax refunds, or inheritance, this tool provides an efficient way to maximize savings without the complexities of refinancing.

Our comprehensive guide equips you with everything needed to understand and leverage mortgage recasting, empowering you to take control of your finances with confidence and clarity.

What is Mortgage Recast?

A mortgage recast allows you to reduce your monthly mortgage payments without altering your loan’s original terms. This process involves making a lump sum payment toward the loan principal, after which the lender recalculates your monthly payments based on the reduced balance. Recasting is an excellent option for homeowners who receive a financial windfall or want to save on interest without refinancing.

Key Features of Mortgage Recast:

How Do You Calculate Mortgage Recast Using Our Tool?

Our Mortgage Recast Calculator is designed to give you quick, accurate results. Simply input the required details to calculate your new monthly payment and total savings. Here’s how:

Step-by-Step Guide:

- Enter Current Loan Balance: Input the outstanding balance on your mortgage. For example, $200,000.

- Provide Additional Principal Payment: Add the lump sum amount you plan to pay toward the principal, such as $10,000.

- Specify Interest Rate: Enter your loan’s interest rate, e.g., 3.5%.

- Enter Remaining Loan Term: Include the remaining loan term in months. For instance, 36 months.

- Click “Calculate”: The tool will display your new monthly payment, total savings in interest, and a breakdown of payments over time.

Example Calculation:

How Do You Calculate Mortgage Recast Manually?

If you want to calculate a mortgage recast manually, it involves understanding the math behind adjusting your monthly mortgage payments after making an additional lump-sum payment toward the principal.

Here’s a detailed, step-by-step explanation with examples and related terms to help you master the process.

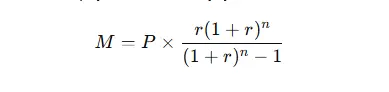

The formula for Monthly Payment:

The formula to calculate your new monthly payment is:

Let’s go through this formula in detail and apply it to a real example.

Step-by-Step Guide Calculation:

Step 1: Reduce the Principal Loan Amount

Start by subtracting the lump-sum payment from your current loan balance. This step reduces the total amount on which interest is calculated.

Example:

Step 2: Determine the Monthly Interest Rate

Convert your annual interest rate into a monthly interest rate. This is done by dividing the annual rate by 12 (the number of months in a year).

Example:

Step 3: Identify the Remaining Loan Term

Find out how many months remain in your mortgage term. This is the number of payments left before the loan is fully repaid.

Example:

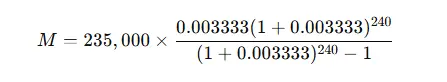

Step 4: Plug Values into the Formula

Use the reduced principal balance (P), monthly interest rate (r), and remaining loan term (n) in the formula:

Example Calculation:

Using a calculator or spreadsheet, the New Monthly Payment = $1,241.25

Step 5: Compare the New Payment with the Original Payment

Calculate the difference between your new monthly payment and the original payment to see how much you’ll save each month.

Example:

Additional Key Points

Top 5 Strategies to Finance a Mortgage Recast

Recasting your mortgage involves making a substantial lump sum payment to reduce your loan principal. This can lower your monthly payments and help you pay off your mortgage faster. Here are five effective strategies to help you secure the funds you need for a mortgage recast:

1. Tax Refunds: Leverage Your Tax Return

One of the simplest ways to gather funds for a mortgage recast is by using your tax refund. If you file your taxes and receive a refund from the IRS, you can apply that lump sum directly to your mortgage principal.

For example, if you receive a $5,000 tax refund, this money can be put towards your mortgage to reduce the balance, which will result in lower monthly payments.

2. Personal Savings: Use Your Emergency Fund

If you’ve been diligently saving money for emergencies or other financial goals, you can consider using a portion of your savings for your mortgage recast. This is a straightforward option as you’re using your own money without incurring debt.

For example, if you’ve saved up $10,000 in your savings account, you can choose to put $7,500 towards your mortgage.

3. Inheritance or Monetary Gifts: Use Windfall Funds Wisely

Sometimes, unexpected inheritances or monetary gifts from family members can provide a lump sum that can be applied directly to your mortgage.

For example, if you inherit $50,000 from a relative or receive a $25,000 gift, you could use a portion of that money to recast your mortgage.

4. Home Equity Line of Credit (HELOC): Borrow Against Your Home’s Equity

A Home Equity Line of Credit (HELOC) allows you to borrow against the equity you’ve built up in your home. This can be a smart strategy if you have significant equity in your home and want to take advantage of a low interest rate.

For example, if your home is valued at $300,000, and you owe $150,000, you might have around $150,000 in home equity. You could borrow $30,000 from a HELOC to recast your mortgage.

5. Sell Unused Assets: Generate Funds by Liquidating Valuables

Selling unused assets such as vehicles, jewelry, collectibles, or other high-value items can provide you with the cash you need to recast your mortgage.

For instance, if you have a car worth $10,000 or a collection of vintage jewelry valued at $8,000, selling these assets could give you the lump sum needed to pay down your mortgage.

How it Helps: This strategy helps you free up cash from items you no longer need and use it to lower your mortgage and improve your financial situation.

Understanding the Components of Mortgage Recast

To confidently navigate the process of mortgage recasting, it’s important to grasp the key components involved. Here’s a detailed and easy-to-follow explanation:

1. Principal Balance

- Definition: The principal balance is the amount you still owe on your mortgage, excluding interest.

- Impact: By making a lump sum payment toward the principal, you reduce the overall balance. This leads to lower monthly payments while retaining the same loan term.

- Example: If your remaining loan balance is $200,000 and you pay an additional $10,000, your new balance becomes $190,000.

2. Interest Rate

- Definition: This is the percentage charged by your lender for borrowing funds, calculated annually but applied monthly.

- Role in Recast: During a recast, your interest rate remains unchanged. This is particularly advantageous if your current rate is lower than prevailing market rates.

- Key Note: Unlike refinancing, recasting avoids the risk of a higher interest rate while still delivering cost savings.

3. Loan Term

- Definition: The loan term is the agreed-upon period over which you repay your mortgage, typically 15, 20, or 30 years.

- Effect of Recast: Your loan term doesn’t change during a recast. Instead, the monthly payment is recalculated based on the reduced principal.

- Example: If you have 15 years (or 180 months) left on your loan and reduce your balance, your payments will adjust accordingly, but the 15-year period remains fixed.

4. Fees

- Definition: Fees are the costs associated with processing a recast, which are generally minimal compared to refinancing.

- Typical Amount: Lenders usually charge between $250 and $500 for a recast.

- Benefit: Since refinancing often involves closing costs in the range of 2-5% of the loan amount, recasting is a more affordable option.

5. Lender Requirements

- Eligibility Criteria: Not all loans or lenders qualify for recasting. Some common conditions include:

- A minimum lump sum payment, often $5,000 or more.

- Consistent on-time payments on your existing mortgage.

- Action Step: Always check with your lender to confirm whether your loan allows for a recast and what specific requirements must be met.

Final Verdict

Mortgage recasting is a powerful financial strategy that can significantly lower your monthly mortgage payments, save you thousands in interest, and provide flexibility for managing long-term debt.

By leveraging tools like a Mortgage Recast Calculator, homeowners can effectively apply lump-sum payments from tax refunds, personal savings, or windfalls to reduce their principal balance and achieve immediate financial relief.

With minimal fees and no change to your existing loan terms or interest rate, recasting offers a straightforward alternative to refinancing. The manual calculation process further empowers those looking for transparency and control over their mortgage adjustments.

By understanding and utilizing this tool, you can take confident steps toward financial stability while maximizing your savings over time.