Truck Loan Calculator

Calculate your Truck loan payments and view the complete amortization schedule

| Month | Principal | Interest | Total Payment | Remaining Balance |

|---|

Finding the perfect truck loan can be a daunting task, especially when juggling multiple factors like interest rates, monthly payments, loan terms, and total costs.

Many people face challenges understanding how much they’ll owe each month, how much interest they’ll pay over time, or how to plan a budget effectively. Without the right tools, this can lead to frustration, miscalculations, or even financial strain.

That’s why our Truck Loan Calculator is designed to simplify the process. With user-friendly inputs for truck price, down payment, interest rates, and loan terms, it provides an instant breakdown of monthly payments, total interest, and amortization schedules.

Whether you’re buying a $50,000 truck or need to finance with a 5.99% interest rate over 60 months, our calculator empowers you with accurate insights to make informed decisions and secure the best loan for your needs.

How Do You Calculate Truck Loans With Our Tool?

Our Truck Loan Calculator makes loan calculations fast and effortless. Follow these steps to get precise results:

- Enter the Truck Price

Input the full price of the truck you plan to purchase. For instance, if your truck costs $50,000, type this amount into the field. - Add the Down Payment

Specify the percentage of the truck’s price you’ll pay upfront. For example, if you’re paying 15% down, the tool calculates this as $7,500. - Set the Interest Rate

Enter the annual interest rate offered by your lender, such as 5.99%. This ensures accurate monthly payment and total interest calculations. - Select the Loan Term

Choose the loan duration. For example, a 60-month term (or 5 years) spreads the cost over manageable monthly payments. - Click “Calculate”

Instantly view:- Loan Amount: The amount you need to finance (e.g., $42,500).

- Monthly Payment: Your recurring monthly cost (e.g., $821.45).

- Total Interest: The total cost of interest over the loan (e.g., $6,786.79).

- Total Cost: The combined price of the truck and interest (e.g., $49,286.79).

- Amortization Schedule

The tool also provides a breakdown of your payments month by month, showing how much goes toward principal and interest. For example, your first payment of $821.45 might include $609.30 toward principal and $212.15 toward interest, leaving a balance of $41,890.70.

How to Calculate Truck Loans Manually?

Calculating truck loan payments manually might seem challenging, but it becomes easier when you break it down into smaller steps. Below is a step-by-step explanation using the loan payment formula, detailed calculations, and examples to help you understand the process.

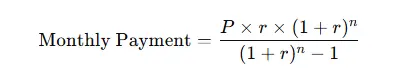

Step 1: Understand the Loan Payment Formula

The formula for calculating monthly payments is:

Step 2: Break Down the Loan Terms

Let’s use a practical example to calculate the monthly payments for a truck loan with the following details:

Step 3: Calculate the Down Payment

The down payment is a percentage of the truck price. Multiply the truck price by the down payment percentage:

So, the down payment is $7,500.

Step 4: Determine the Loan Amount

Subtract the down payment from the truck price to get the loan amount:

Therefore, you are financing $42,500 for the truck.

Step 5: Convert the Annual Interest Rate to a Monthly Rate

Since the formula uses the monthly interest rate, divide the annual interest rate by 12:

Step 6: Determine the Total Number of Payments

Multiply the loan term (in years) by 12 to get the total number of monthly payments:

So, the total number of payments is 60 months.

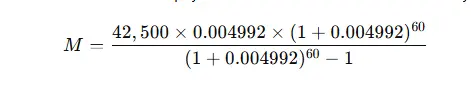

Step 7: Plug the Values into the Formula

Now, substitute the values into the formula to calculate the monthly payment:

Step 8: Simplify the Calculation

To make the calculation clearer, let’s break it down step by step:

- Calculate (1 + r)^n:

- (1 + 0.004992)60 ≈ 1.34885

- Multiply P×r×(1 + r)^n:

- 42,500 × 0.004992 × 1.34885 ≈ 286.57

- Calculate (1+r)^n – 1:

- 1.34885 − 1 = 0.34885

- Divide the numerator by the denominator:

- 286.57 ➗ 0.34885 ≈ 821.45

Final Monthly Payment

The monthly payment is approximately $821.45.

Top 5 Strategies to Finance a Truck

Financing a truck is a significant investment, and making the right financial decisions can save you thousands of dollars over time. Whether you’re purchasing a commercial vehicle or a personal-use truck, employing strategic financing techniques ensures affordability and efficiency. Below are the top five strategies to finance a truck, explained in detail to help you make informed choices.

1. Save for a Larger Down Payment

One of the most effective ways to reduce your overall loan burden is by increasing your initial down payment. By putting more money upfront, you can:

For example, on a $50,000 truck purchase, increasing your down payment from 10% to 20% could save you thousands in interest over a five-year term.

2. Shop Around for Low Interest Rates

Interest rates significantly impact the total cost of your loan. Taking time to research and compare loan offers can yield better rates and terms. Consider exploring:

Even a small difference in interest rates (e.g., 5.99% versus 5.5%) can result in substantial savings on a long-term truck loan.

3. Choose the Right Loan Term

Your loan term determines the duration and structure of your repayments, impacting both monthly costs and total interest paid. When deciding on a term, weigh the pros and cons carefully:

For instance, a 36-month loan may save you money in interest compared to a 60-month loan, but only if you can manage the higher monthly payments.

4. Improve Your Credit Score

Your credit score plays a critical role in determining your loan’s interest rate and terms. A strong credit profile signals reliability to lenders and can help you secure better financing options. To improve your credit score:

A jump from a “fair” (620–659) to a “good” (660–719) credit score could lead to significant savings, as lenders often reward higher credit scores with reduced rates.

5. Consider Pre-Approval

Getting pre-approved for a truck loan is a smart move that offers several benefits:

Pre-approval also lets you lock in interest rates for a specific period, protecting you from potential rate hikes during your truck-buying journey.

Understanding the Key Components of Truck Loans

When financing the purchase of a truck, understanding the various components of the loan is crucial to making an informed decision. A truck loan is made up of several essential elements that determine how much you’ll pay each month and the total cost over the life of the loan. Here’s a breakdown of the key components:

1. Loan Amount (Principal)

The loan amount is the total sum you borrow from the lender to purchase the truck. This is typically the truck price minus any down payment you make upfront. The loan amount directly impacts your monthly payments, as well as the overall interest you’ll pay over time. The larger the loan, the higher your monthly payment and total interest cost will be.

- Example: If the truck’s price is $50,000 and you make a down payment of 15% ($7,500), the loan amount would be $42,500.

2. Interest Rate (APR)

The interest rate (or annual percentage rate, APR) is the cost you incur for borrowing the loan amount. It is expressed as a percentage of the principal and can vary based on your credit score, the length of the loan, and the lender’s policies.

The interest rate determines how much extra you will pay on top of the principal, affecting both your monthly payment and total loan cost.

- Example: A 5.99% APR means you will pay 5.99% of the loan amount annually in interest, which is factored into your monthly payments.

3. Loan Term

The loan term refers to the length of time you have to repay the loan, often expressed in months. Common truck loan terms range from 24 months (2 years) to 84 months (7 years).

The loan term impacts your monthly payment and the total amount of interest paid over the loan period. A longer-term usually results in lower monthly payments but higher overall interest costs. A shorter term means higher payments but less interest paid in the long run.

- Example: A loan term of 60 months (5 years) is common for truck loans, balancing monthly payments and interest.

4. Monthly Payment

Your monthly payment is the amount you will pay each month toward repaying the truck loan. It is determined by the loan amount, interest rate, and loan term. The monthly payment includes both principal (the amount borrowed) and interest (the cost of borrowing).

A higher loan amount or interest rate will result in a higher monthly payment. Conversely, a longer loan term can reduce the monthly payment, but it may increase the total cost due to additional interest.

- Example: For a $42,500 loan, with a 5.99% interest rate and a 60-month term, the monthly payment could be approximately $821.45.

5. Total Interest Paid

The total interest paid over the life of the loan is the amount you’ll pay beyond the loan amount to cover the cost of borrowing. The interest is calculated based on the loan amount and the interest rate.

It is crucial to understand the total interest, as it can significantly impact the overall cost of the truck over the loan term. Higher interest rates and longer loan terms lead to more interest paid.

- Example: A 5.99% interest rate on a $42,500 loan with a 60-month term could result in a total interest cost of approximately $6,786.79.

6. Amortization Schedule

The amortization schedule provides a detailed breakdown of each payment, showing how much of your monthly payment goes toward the principal (the loan amount) and how much goes toward interest.

In the early months of the loan, a larger portion of your payment goes toward interest. As the loan progresses, more of the payment is applied to the principal balance. The amortization schedule helps you track your progress in paying down the loan and provides clarity on your financial commitments.

- Example: In the first month, a payment of $821.45 may include $212.15 toward interest and $609.30 toward the principal.

7. Total Loan Cost

The total loan cost refers to the loan amount plus the total interest you will pay over the life of the loan. This is the full amount you will ultimately pay for the truck.

Understanding the total loan cost is essential for assessing the loan’s affordability and ensuring you’re comfortable with the financial commitment.

- Example: For a $42,500 loan with $6,786.79 in interest, the total cost of the truck would be $49,286.79 throughout the loan.

Factors Affecting Truck Loans

When applying for a truck loan, several key factors come into play that can influence the loan terms, monthly payments, and total interest. Understanding these factors helps you make an informed decision when financing your truck purchase. Here’s a detailed look at the main elements that affect truck loans:

1. Credit Score

Your credit score plays a critical role in determining the interest rate and loan terms offered by lenders. It is a numerical representation of your financial health and how well you have managed debt in the past.

Lenders use this score to assess the risk of lending to you. Generally, the higher your credit score, the more favorable the loan terms.

For example, a higher score typically translates to lower interest rates, which can significantly reduce your monthly payments and total interest paid throughout the loan. Conversely, a lower credit score may lead to higher rates and less favorable loan conditions.

2. Truck Price

The price of the truck you intend to purchase is one of the most significant factors in determining your loan amount. A higher-priced truck will naturally require a larger loan, which results in larger monthly payments and a greater total loan amount to be repaid.

As the loan amount increases, the interest charges also tend to rise. Be mindful of how the price of the truck impacts your monthly budget and long-term financial plans. A higher truck price might be appealing, but it can lead to a higher debt burden in the long run.

3. Down Payment

The size of your down payment has a direct impact on the loan amount and the total interest you will pay over time. A larger down payment reduces the overall loan principal, lowering your monthly payments and the total interest.

By paying more upfront, you borrow less, which can make a big difference in your overall financial picture. Additionally, a larger down payment can improve your chances of securing a loan with better terms, especially if your credit score is less than ideal.

4. Interest Rate

The interest rate on your truck loan is one of the most important factors that directly affects both your monthly payments and the total cost of the loan.

A lower interest rate results in lower monthly payments, while a higher interest rate increases your financial burden over the life of the loan. Even a small fluctuation in the interest rate can have a substantial impact on your loan payments and total interest paid.

Factors such as your credit score, current market rates, and the loan term all influence the rate you are offered. It’s essential to shop around and compare interest rates from multiple lenders to ensure you get the most favorable terms.

5. Loan Term

The loan term refers to the length of time you have to repay the loan, typically ranging from 36 months to 84 months. Longer loan terms generally result in lower monthly payments, as you’re spreading out the loan balance over a more extended period.

However, this comes at the cost of paying more total interest over the life of the loan. A shorter loan term results in higher monthly payments but less total interest paid.

It’s important to balance your budget and choose a loan term that makes sense for both your short-term financial needs and long-term financial goals.

6. Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is another crucial factor that lenders use to determine your loan eligibility and terms. This ratio compares your total monthly debt payments to your gross monthly income.

A lower DTI indicates a lower financial burden relative to your income, making you a more attractive borrower to lenders.

On the other hand, a higher DTI suggests that you might be over-leveraged, which could result in higher interest rates or difficulty getting approved for a loan. It’s advisable to keep your DTI within a healthy range to improve your chances of securing a truck loan at favorable rates.

7. Down Payment Size and Loan Approval

The size of your down payment can also impact the approval process. A larger down payment demonstrates your commitment to the purchase and reduces the lender’s risk, which may improve your chances of loan approval.

If you’re working with a less-than-perfect credit score, a substantial down payment can help offset the perceived risk and increase your chances of securing a loan.

Final Verdict

The Truck Loan Calculator is a game-changing tool that simplifies the complexities of financing a truck purchase.

Whether you’re buying a $50,000 vehicle or financing at a 5.99% annual interest rate over 60 months, this calculator breaks down every detail—from loan amount and monthly payments to total interest and amortization schedules.

By providing clear insights into principal balances, interest costs, and payment structures, it empowers buyers to make well-informed decisions tailored to their financial goals.

With intuitive features like precise loan calculations, amortization schedules, and expert strategies for optimizing down payments and securing low-interest rates, this tool is your ultimate companion for navigating truck loans effortlessly.